Anyway, I've lost any resentment toward the new Michter's and its driving force, Joe Magliocco. That's largely due to two things: the passion Joe and his team have for simply finding, blending, aging, distilling (and, importantly, filtering; more on that later) the very best whiskey possible; and, well, the whiskey they produce is simply phenomenal.

When the news came out that they were releasing another batch of 20 year old, I asked Joe if I could get a sample. Suggested retail is $700; I asked for 50 ml. Joe wasn't having that, and sent me a full bottle. So yes, I got a free bottle. I get a lot of those. I also am not a huge fan of really old, woody whiskey, so I was going to give this the treatment.

But I also told Joe that if I was going to review the whiskey, I wanted to talk to Andrea Wilson about it. Andrea is Michter's Master of Maturation, the person who oversees the aging process, does the blending, the person who takes the sourced barrels Michter's bought (prior to 2015) and what master distiller Dan McKee makes and turns it into whiskey. I did a presentation on American whiskey history and production with Andrea at the Smithsonian last October, and we worked well together. I was looking forward to talking whiskey with her again.

After getting healthy, we finally set a date and talked this past Wednesday: Andrea, Joe, and myself. I had a pour of the 20 year old handy, as did Andrea; Joe was chagrined to find there was no 20 year old available at his New York office!

(As is usually the case, I talked to Andrea and Joe on the phone and took down what they were saying as fast as I could...but some of this is direct quote, some of it is paraphrase. When I had problems, I asked them to repeat things. I did the best I could, but it is not a direct transcript.)

Is there anything you can tell me about where this came from? It's all Kentucky, and it's all at least 20 years old. Anything else?

Joe Magliocco: We talk about the three phases*; obviously, this is Phase I whiskey, before we were cooking in someone else's kitchen. This is whiskey from a long time ago, when we were going around Kentucky buying things. We had to sign a confidentiality agreement. The environment in those days was much different. People were just happy to unload stuff.

The Phase I sourcing was me going around with Dick Newman*...and Steve Ziegel (Joe's long-time head of sales). Like me, Steve's not a production person, he just likes whiskey. We wanted to pick something we liked. This was in the late 1990s, and there was plenty of good stuff available. We didn't know we'd ever get to the point where we could produce by ourselves, but we wanted to pick a style we liked and could emulate. It's rich, a lot of flavor, and also interesting: a flavor experience, on the front, different on the palate, and different again in the finish. Steve said, we want it to warm, but not burn. This fit that bill.

(We talked here about how a 20 year old gets picked, and when they decide to do one.)

JM: A lot of people visit us and ask why do you have steel drums [for storing whiskey]? It's one of the things we do that makes our older stuff special. Andrea?

Andrea Wilson: We have a Quality Control system, and part of it is the drums, like mini-tanks. If we taste something, a barrel, that's at peak, and we don't think it's going to get better, we'll take it out and put it in the drums. (Transferring to stainless steel drums halts aging, preserving the whiskey.) We'll use that as a tool. Not every barrel goes through that process, but we use it so we have a uniform, delicious final product. Everything we're doing here is to produce the best American whiskey. We've had to look after these barrels for many years, and we're known for that, for not letting them get over-oaked. [This was news to me; I didn't realize Michter's was buying new make and aging it in their barrels. Makes sense, in retrospect.]

JM: If Andrea feels that a barrel is good, and not going to get better, even if it's 19 years old, we'll take it out and that stops the clock. But we don't want these whiskeys to be wood bombs. When it gets to our older offerings, we don't really know what we'll have, because we don't know what's going to fit our protocol. Some years we don't offer 20 year old, we don't offer a 25 year old, because we don't have it every year. When people get a 20+ year old from Michter's, it's going to be really good, not just 20 years old and maybe it's good or not.

You have a barrel-by-barrel approach all through the process.

JM: It was [former Michter's master distiller] Willie [Pratt]'s idea to maximize the size of the tanks to the contents of 24 barrels: maximum. Even our small batch products, like the US-1, they're very small batch. And if you have one bad barrel out of 15 or 20, it's going to taste terrible. If every barrel isn't just right, they can't use it. And if we have a bad one, it gets sent to a company that re-purposes it as fuel alcohol. We don't blend it off, or sell it as whiskey, it gets rejected.

How do you select the barrels to do a 20 year old? Who's involved, and when? Is it just you, Andrea?

AW: We have a tremendously skilled team. We don't make decisions in isolation. The collective experience of the team is leveraged to make those decisions. Joe always has focused on the importance of having a great team around you. That's a critical factor of the success of Michter's. We've tried to encourage a culture here. You don't leave things to chance, there's a control. We have people in our department who have the mentality of a chef. They test everything, they have a discipline and an artistry. We talk a lot about chefs here.

The bottle you sent was #329 of 440, Batch 19H1439. What does all that tell me?

AW: 19 is the year of the bottling, 2019. H is the month, August. And 1439 is a proprietary bottling code for us.

Is the code a tracking code?

JM: You could say that's what it is.

How many barrels went into this batch?

JM: We don't talk about things like that. When you get stuff that's really old like this, you may get a barrel that's almost empty. I know from experience, you can have a barrel with very, very little left.

AW: That's why we evaluate every barrel individually to get the ones that are going to work well together. It's part of the artistry of blending. It's about creating a beautiful product. We talk about the art and science of what we do; this falls into artistry. It's like making perfume. You can have a lot of beautiful floral scents, but they won't necessarily come together to make something beautiful. It's about assembling a symphony of flavor.

What kind of bourbon do we have here? Wheat, rye, a combination?

JM: We're not going into the mashbill. Some people will tell you every detail. Willy always felt that some things should be secrets.

|

| Andrea and I after wowing the Smithsonian. |

AW: They do get their own custom filtration. They're very old whiskeys, with a tremendous amount of complexity, but they're very delicate. So we use a looser grade of filter, and add very little water. It's a very careful set of decisions.

Is that why 57.1%? Is that barrel proof?

AW: The complexity of the bonding of the flavors is much more... [long pause here]

What do you mean by bonding of the flavors?

AW: When you are working with older whiskeys, the complexity of the chemical bonding of the whiskey is much tighter. When you add water, you risk breaking the bonds that took years to develop in the aging process, and it's something to be mindful of.

How long is it going to be before we see a Phase III 20 year old? I hope I'm still allowed to drink by then!

JM: Let's think about this. 2035, right Andrea?

AW: That's right, we started distilling in 2015.

JM: You want to buy a few bottle futures?! [general laughter ensues]

Tasting --

I gotta say, the color is just gorgeous.

AW: We had samples lined up on a table, and the color...it was just stunning.

It smells sweet. Can a thing smell sweet? That's a taste, isn't it?

AW: Sweet is a taste more than an aromatic, but there are scents that come forward from sugar, from butter, from cream, that make you smell sweetness.

It's lush, sweet, caramel, creamy on the palate. There's a berry brightness, too. Some nice nut aromas.

AW: I don't get berries in bourbon. I get cherries. Everyone's different. Reminds me of being in Savannah and having pecans; roasted, candied pecans.

Not a lot of heat for the proof. Soothing on the tongue.

AW: It does have a really long finish, like a syrup experience, where it coats a bit.

I've really only had a few whiskeys at this proof that were this smooth, not hot. That's special.

[That was all we had to say. I thanked them for their time, and got to work on this. And then today, I revisited the whiskey.]

Clearly an older whiskey with the spires of oak soaring through the nose, but the spires don't overshadow the hall packed with a full array of bourbon aromas below. This has maintained its youth well: roasted sweet corn, vanilla, that buttery creaminess, and okay, berry and cherry, and roasted nuts. That is a treasure chest full of delight, that nose.

The palate is easily recognized from the aroma, but to my surprise, there's actually some fresh grassy character there! How does that happen with a 20 year old? The finish rolls on after, a runaway freight car rolling down a seven-mile incline that just cannot be stopped, only receding into the distance.

This is going to be a hard bottle to save and savor. I want to have more later tonight, let alone tomorrow. Well done, Andrea; well done, Joe, Dick, and Steve. Well done, Phase II.

Oh, and by the way, my Dry(-ish) January is over.

*Michter's is following a plan of whiskey production. Phase I, the earliest bottles they put out, were whiskeys that Joe, Dick Newman (former CEO of Austin, Nichols (which owned Wild Turkey) and the head of the Old Grand-Dad, Old Crow, and Old Taylor brands when he was at the old National Distilling), and Steve Ziegler (Joe's head of sales) selected barrels for bottling. As Joe said, things were different then, and whiskey was easily found and purchased.

Phase II involved Joe and his distillers going out to distillers with excess capacity and having them make distillate to their specifications (which they'd honed in those years of buying Phase I barrels). Again...back then there were places that were happy to make some money making spirit for someone else.

Phase III came about when the market heated up, and it was clear that the line moving up labeled "Does it make sense to build our own distillery?" and the line moving down labeled "Does it still make sense to stake our future on buying spirit from others?" were going to cross pretty soon. So Joe and his brothers (silent partners) built a distillery just outside of Louisville (an historic distilling area, near Stitzel-Weller and Early Times), and since 2015, they've been making their own spirit...which is going to be ready fairly soon. No 20 year old Phase III for a while, though!

**Willy Pratt experimented with different types of filtration, and found that not only did they result in different flavor/aroma effects on the whiskey, but they affected whiskeys differently based on how old they were. It sounds like bullshit, frankly, but I've blind-tasted it at Michter's and it's pretty clear.

Ken Grossman has been at the helm from the beginning, and running things solo for over half that time. He's starting to step back now (more about that below), but make no mistake: Ken made Sierra Nevada what it is, what it became, and what it's been. There have been huge contributions from other folks, but Ken's hand is on the tiller.

I got an opportunity to interview him today, and I wanted to get that right up. I also sampled the 40th, and tasting notes are at the end of the interview. (As is usually the case, I talked to Ken on the phone and took down what he was saying as fast as I could...but some of this is direct quote, some of it is paraphrase. When I had problems, I asked him to repeat himself. Generally, though, he was pretty thoughtful and slow.)

I'm in italics, Ken is in plain type. I didn't do my usual bolding except for the first few words to make it easier to pick out when things stop and start, and a few things I found exceptionally interesting, like the statement on Sierra Nevada hard seltzer, and one of the "argued over" issues, and the Sierra Nevada whiskey that never happened.

Congratulations on 40 years! I've been drinking Sierra Nevada on the regular since 1987, and enjoying the hell out of the ride. But my favorite Sierra Nevada beer is still the Pale Ale, which I never tire of (my wife splits her fave: Celebration when it's in season, Torpedo when it's not). Do you have a favorite year-round or annual from the line-up?

I drink Pale, but I don't stick with one style. I drink through the portfolio pretty regularly. In the past few weeks, I had Porter, 40th, Bigfoot, Pale, and some of our new Kombucha. I went over to [the Sierra Nevada Torpedo Room in] Berkeley and tried some of the small batch beers there. I try to always keep tasting and enjoying everything. I'll rotate through the seasonals when they first come out. I really enjoyed the Bigfoot this year. You know, I get that question a lot, and I usually tell them it's like trying to pick your favorite child.

Yeah, sorry, people ask me my favorite whiskey all the time. But it brings up a sadder question: which Sierra Nevada beer that didn't make year-round or regular annual status do you miss the most? For me: Glissade, a wonderful lager we still talk about. How about you?

Glissade, that was a great beer. There are plenty of them, but the realities of the market, the support you need from wholesale and retail involves a certain velocity. So even if the beer's fantastic, if the volume's not enough, the retailers will pull it, the wholesalers see that, and we're supporting something that, for whatever reason, isn't making it. Do we want a brand that's not in a good growth mode, or something that's more where the consumers' tastes are? And it might be tastes, might be the branding, or it might be something else. Hazy Little Thing took off more than we expected last year, it was 98% growth. It caught us a bit off guard. We'd predicted 40,000 bbls. First year doubled that, and then doubled that again.

The 40th seems to be a very Sierra Nevada beer: a 3C (Cluster, Cascade, Centennial hops) IPA, relatively dry, and a very drinkable 6%. But what about the oats and acidulated malt? Is that a regular thing that I just don't know about, or is it something different for this beer?

We do oats in quite a few beers for the mouthfeel; in intentionally hazy beers we use a lot of them. We do use levels of acidulated malt in a number of beers, just for balance of acid. It's a malt that goes through a lactic step before kilning, it helps with pH balance, gives a softness in the flavor.

The hops...we were trying to go back to 1980. Cluster was the American hop, Cascade wasn't quite as popular then as it would be, and then Centennial would come later, the super-Cascade.

You know, Cluster never really got a fair shake in America. It's been around for years in variants. This aromatic hop, it was so different from what the German brewers were used to using, those subtle Noble hops. The American brewers were mostly German trained, so they weren't used to that in-your-face aroma. But it was considered an acceptable source of bittering, not as an aroma hop. As more aggressive, higher-alpha (acid) hops were bred, the Clusters fell to the wayside. It has a unique character, and we've played with it in various formulations. It's about 6% Alpha, and you've got bittering hops with triple that now. It doesn't yield that well (per acre), and doesn't have a competitive place as a bittering hop. We've grown some Cluster, and we've gone out and picked wild Clusters outside of Chico [in the area of an old hop farm]. It adapted to the climate down here and does well for what it is. It seemed like a no-brainer.

Cascade we used in a lot of our early beers, and Centennial is just a great all-round hop. You've probably heard of beers that are focused on Centennial that are in the top few beers in the country.

It's hard being an established and large craft brewer these days. It hardly seems fair, to have done the hard pioneer work, to be making some of the best beers you've ever made, and see attention and sales go to new, small, "cool kid" brewers. Is there a path to continued success as a large craft brewer? Do you just keep making good beer?

That's table stakes. The majority of the small brewers are now making good beer. To be considered in the competitive set when people pick a beer to buy, we have to make great beer. We've been innovating, spreading our wings. We're looking at other alcohol beverages than beer. We just put on our first hard kombucha. We've got a great team put together for using bacteria and other yeasts.

We're about to release Wild Little Thing, a lactic, somewhat tart beer, should be out in a few months. Just tasted the latest batch. We want to appeal to a wider band of beer drinker. Hazy Little Thing appeals to people who are not necessarily core Sierra Nevada drinkers, may not even be aware of the traditional Sierra Nevada beers.

And we're working in alternatives: Kombucha is one, and we're looking at others. I don't know that we'll do an alcoholic spritzer. We'll want it to have some more meaning and soul, more in line with what we are than just fermenting sugar and putting flavor in it. The Kombucha we hope will appeal to a similar consumer. We worked really hard at making it, the cultures are ones we intentionally put together. Most of them are combinations of yeast and bacteria that just happened, passed on from a friend's uncle. We've been purposeful about that: a little funky but not a lot, lower alcohol, organic. I think it has a lot more to offer a drinker that wants something that's better for them. We wouldn't call it a health beverage, but the things people are concerned about: carbs, alcohol, it meets those needs in an organic package.

But to get back to your question? Just make great beer and keep up with the changing drinker. We have to, you know. The younger folks drink more than us as we age.

Looking back on all that you've done -- starting a successful family-owned business, creating the American pale ale and American barleywine styles, pioneering estate brewing and wet hop brewing, going solar, creating 100s of jobs -- what things are you the most proud of having accomplished?

There is a lot. The industry is nothing like what I thought it was going to be 40 years ago, more than 40 years ago, when I was trying to raise money. (Brewing industry pundit) Bob Weinberg was predicting the beer industry would be down to 2 or 3 breweries in 1990.

I'm proud we were part of the revolution that changed the face of beer in America, and set the stage for a change of beer on a global scale. The breweries here weren't innovating, didn't have the cachet of countries like Czech, Germany, UK. And now it's come full circle, we're known for beer more than those people. I played a part in that transformation, and I'm proud of that. Some of our early labels and tools are in the Smithsonian, from our fledgling industry. And with Boulder (Brewing) closing, we're the last man standing, and haven't been sold, so we're the oldest of the pioneers.

Any regrets? Anything you wish you'd done, or Sierra Nevada could have made happen, or in the way craft brewing has turned out?

I wouldn't say regrets. I talked to Fritz Maytag about this when I saw him at the Smithsonian. One of the things I wanted to do in 1980, and I still have the copper pot I was going to do it with: I was going to make an American scotch whisky in 1980. We did supply some wash for St. George back in the late 1980s. One of the guys was just saying a couple months ago, 'If you'd done that when you first got here, you'd have 30 year old whiskey now!' (Would you, though? Would you have kept some that long?!) I like to think we'd have kept at least one bottle!

You've always seemed like a very 'no drama' kind of guy, and Sierra Nevada reflects that: solid, continuing brands, packaging that rarely changes, beers that clearly pay homage to classics, but often make solid advances. Why has Sierra Nevada been so steady all these years, still the same beers at the core, still the same colors and graphics? Is it because of your company culture and your personality, or is it something you could do because you were in this very, very early? Is that a strategy you've followed because it worked, or because it's the way you know?

Several times over the years we've hired firms to do a major refresh of the pale ale. It ended up being the artwork for the XXX package. That's one of the versions that was done for refreshing Pale Ale. There was internal angst about such a big shift – and I love that label – but our family argued over that. That statement on the sixpack; that's one of the things we argued about!

We see other brewers – what's the industry saying, every time you do a package refresh you get a 5% sales bump? But I've seen some brewers go through a half dozen or more in ten years and I think it can do damage to brand equity. I don't think it's all upside. Some brands need a refresh, but every year or two seems like a lot. A homebrewer friend did the original labels, he was in the Maltose Falcons club. Chuck Bennett.

You've got 40 years in, more than that, counting start-up. That's a career for most people. Are you looking to hang up your boots any time soon? Is there an exit strategy for Ken Grossman, and what does the company look like on the other side of it?

We hired a CEO, promoted the COO Jeff White into that last year. I've been slowly unloading stuff that I'd rather not be doing. I'm working less, trying to work myself out of the job. I like the technical stuff, so I still play a role in that. I've got two children involved in the business out here. Brian oversees the customer experience side at all three places. Sierra is on the people side and in the leadership group.

I'm just trying to stay out of people's way, and I stick my fingers in where it makes sense. My wife is always after me to work less, so I took a bike ride this morning, I only have one meeting after this, and then I'll head home. I have a woodshop and a metalshop at home. I bought a welder and a lathe, first pieces of equipment I bought, and I've still got 'em both.

Thanks, Ken. For everything.

Tasting Notes on Sierra Nevada 40th Hoppy Anniversary Ale -- Oh, that beautiful fresh yeast smell. Nothing like a Sierra Nevada ale. Beer's a little bit hazy, with an apricot nectar color and a crunchy white head. Noses pine and pith, with a bit of orange candy. It plays slick but sharp on the tongue, with firm hop flavor -- that pine and citrus again -- but not the gripping bitterness of a Celebration.

In fact, this is a beautiful feat of brewing: they've taken the basic building blocks of their brewing, a brewing tradition (you can certainly say that after 40 years of it) that includes Pale Ale, Bigfoot, Celebration, Torpedo, Tropical Torpedo, and Hazy Little Thing...and once again they've taken those basic ingredients and created a beer that slides into that formation without infringing on any of the others, and yet clearly belongs in that formation. These are all beers that are individuals, and only Bigfoot does that by being hugely different. 40th does it almost all with mouthfeel. Well done!

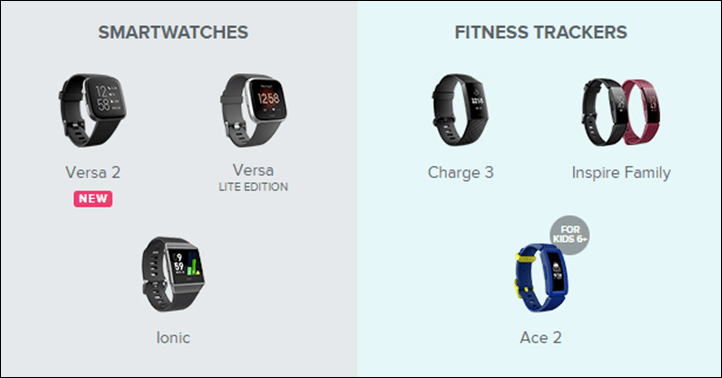

Google has just announced the acquisition of Fitbit for a cool $2.1 billion (USD). The move will undoubtedly drive change in the industry, though, not as much as one might think – at least initially. Don’t worry, I’ll explain in a moment. Like any acquisition, it needs to actually be approved by regulators, but that’s largely just a formality for this particular instance. Google & Fitbit expect that to occur in 2020, which is when the real work can begin.

It’s probably best to start off with where these two companies’ products fit in the market today. Fitbit, of course, being one of the biggest wearable players, though sliding in the last few years as Apple, Samsung, Xiaomi, and Huawei (and to a lesser but still visible extent Garmin) have seen their sales increase significantly (keep in mind that global IDC tracking isn’t a great indicator of North America/European sales). Apple sells approximately 20-25 million Apple Watches per year (and more than double that for the entire ‘wearables’ category). Whereas Fitbit has been in the 13-20 million ballpark the last few years.

Google meanwhile hasn’t sold their own watch device. Instead, they have Wear OS (previously known as Android Wear). That’s an operating system that’s largely focused on the higher end smartwatch with a similar battery profile as the Apple Watch. Meaning, it’s designed to roughly last 1-2 days. Exactly how long it lasts depends heavily on the exact partner hardware. For example, Polar’s M600 (Wear OS) fitness-focused watch tends to last longer than some other companies’ thinner watches. And similarly, we saw Apple decrease actual battery life this year in the Series 5 from past years. Again – it all depends on the hardware under the covers.

Battery aside – Fitbit and Google do have wearables overlap, but it’s kinda messy overlap. For example, Fitbit’s top-end device – the Ionic (priced $200-$250 depending on tidal and moon phases) has music, GPS, and contactless payments. Wear OS devices in that category tended to start from the same price point and increase depending mostly on materials used. Fossil had countless watches all in that price range. However, Wear OS wasn’t situated well for the less expensive all-day activity trackers that made Fitbit popular.

The battery demands of Wear OS (like WatchOS from Apple) simply didn’t allow that. They are blow-torches in the battery department in comparison to the much longer-lasting Fitbit (and Garmin/Suunto/Polar/etc…) wearables. A large part of that is the screen – Wear OS devices tended to have far more vivid screens. And as we saw this year with Fitbit, Apple, and Garmin introducing always-on screens like Samsung has had – when enabled, it more than halves the battery life.

Next, if we look at the health side of things- while Google has their health platform, it doesn’t have anywhere near the depth of Fitbit from a social fitness tracking standpoint. Nobody really does. That’s why Fitbit has succeeded to date: Their platform is engaging. Even looking to Apple, for example, one can see the huge lack of social engagement between Apple Watch users. You can do basic competitions, but the methods and challenges that Fitbit has, exceeds everyone else’s capabilities.

What does it mean for FitbitOS & Wear OS?

So the real question here is: Which OS wins?

The easy answer is ‘Wear OS’, and to an extent, Google says that as well. Their SVP of Devices and Services, Rick Osterloh noted that this “an opportunity to invest even more in Wear OS as well as introduce Made by Google wearable devices into the market.”

But the challenge with that broad-brush statement is somewhat twofold:

A) Wear OS isn’t viable for Fitbit’s non-smartwatch activity trackers

B) Wear OS is still a battery beast

Not to mention that Wear OS still has relatively little uptick in apps (just like Fitbit does). Sure, the app stores are full of apps, but very few that you’ll actually use beyond a cursory one or two time glance.

Realistically – Google and Fitbit are going to have to keep both platforms running, likely for many years. But that might not be all bad. Take the lower end wearables (the Inspire and Charge families), there’s no reason to even bother trying to port Wear OS onto these devices. Instead, Fitbit/Google will likely keep them on the platforms they’re on (the core Fitbit platform that was there prior to FitbitOS proper). They can add in things like Google Assistant down the road (they added Alexa to the Versa 2 this past summer) and since there’s no apps on these, much of the benefit of Wear OS is negligible or non-existent.

Meanwhile, you’ve got the Versa and Ionic lineup. These have strong overlap with Wear OS and are likely to be canned from an operating system standpoint. At first glance, you might assume that FitbitOS is newer than Wear OS (or Android Wear). But in reality, one has to remember that FitbitOS is essentially just a spin-off of the Pebble operating system (remember, Fitbit bought Pebble). In fact, some of those lead Pebble engineers are still there leading this platform. But, I can’t see any scenario where they keep FitbitOS. There’s simply no reason to.

All of the fitness and lifestyle type interfaces and functionality that run on a Versa or Ionic type watch can easily be ported over to run on Wear OS. Sure, there will be differences, but because Fitbit’s products are fairly modular and also less deep in individual functions than say something like a Garmin watch, it’ll be easier to stock replace pieces like the music player or even basic run tracking. Wear OS does those just fine today – and not appreciably different than Fitbit.

So in short – I’d argue FitbitOS goes away, Wear OS continues, and basic Fitbit trackers stay the course on their proprietary platform as they have for more than a decade.

What does this mean for Fitbit users?

And this is where things get a bit messy. See, they say almost nothing about existing Fitbit users in their press release except this single line item:

“Consumer trust is paramount to Fitbit. Strong privacy and security guidelines have been part of Fitbit’s DNA since day one, and this will not change. Fitbit will continue to put users in control of their data and will remain transparent about the data it collects and why. The company never sells personal information, and Fitbit health and wellness data will not be used for Google ads.”

At first you might think – great, that means all is well, right?

Not so fast. What’s missing in this entire press release is any commitment whatsoever to maintaining the Fitbit platform or ecosystem. Bizarre as that omission might seem (since that’s what Fitbit is so well known for), it means Google is keeping all options on the table – including burning down that ecosystem to fold into other projects (which historically the company tends to do for acquisitions, they’ve acquired at last 229 companies as of today).

In fact, when I asked Fitbit’s PR team about any commitment (at all) to existing Fitbit users – they said:

“The release and blog post are the comments for now.”

In other words – ‘no comment’.

That could be taken both ways. But I know better. We all know better.

When it comes to acquisitions, if a company plans to keep something – they say it (and usually say it loudly and proudly – like they did above with the security/privacy bits). If a company has even the slightest thought of not keeping it, they say nothing. And if the company plans to burn it down, they definitely say nothing.

This is a pretty big deal for neither Fitbit or Google’s statements to address.

They do however offer one other line item around compatibility, which is:

“Fitbit will continue to remain platform-agnostic across both Android and iOS.”

And that makes sense. After all, Wear OS works today on iOS and Android devices, and there’s no reason to shift away from that. Most companies in this segment find that they have 60-70% iOS market share for consumers of these types of devices (as compared to far higher global Android market share). Thus, ditching iOS support would be a self-inflicted wound.

Impact on their competitors?

Interestingly, Garmin was asked this very question on their earnings call this week by Robert Spingarn of Credit Suisse. CEO Cliff Pemble said the following:

“So we’ve seen the speculation obviously around Fitbit and Google. It’s really hard to say what we can think about that without any kind of formal announcement and whether or not it’s even a real thing.

We believe that Fitbit’s customer base is very different from ours and our product focus is also different. So it’s not something that we believe impacts us and we’re not worried about it.

In terms of other opportunities, we look at every opportunity basically in terms of what it can bring to Garmin both in terms of technology or product lines. So we would evaluate any of those opportunities based on that and what we can achieve with it going forward.”

Of course, he brushes off the concern – but what he states in the middle paragraph is mostly untrue. Fitbit and Garmin have always had huge overlap at the low-end, and have always competed head to head there. They’ve referenced Fitbit as a competitor in their earnings calls and sales guidance for years.

However – there’s also some nuances to what he says. What he’s probably trying to say is that ‘A Garmin customer is less likely to become a Fitbit customer, whereas a Fitbit customer is more likely to become a Garmin customer’. Meaning that the athlete-focused feature set of a Garmin watch is easier to ‘upgrade’ into from a Fitbit device, but harder to go back to a Fitbit device once on a Garmin (speaking purely from a feature standpoint). They have overlap, but the bulk of Garmin’s *revenue* comes from their mid-range and higher-end devices, not from the activity trackers that they still compete with Fitbit on.

The other two players this impacts are Apple and Samsung.

But predicting how it’ll impact them is a tricky beast. Obviously, this will give Wear OS strength over time, but not immediately. Apple’s integration between phone and watch is second to none. The cleanliness of that integration is in many ways the cleanliness of Fitbit as an ecosystem. Whether or not Google can find a way to port not just the overarching fitness platform to Google proper, but also retain that cleanliness remains to be seen.

I don’t see this making any appreciable negative impact on Apple (or Samsung) anytime soon. I could, however, see this having a detrimental effect on Fitbit sales near-term, whereby people actually end up on an Apple Watch (or other competitor) due to uncertainties around Fitbit. As I often say, the ‘Best Buy’ effect. Meaning, consumers of this type of device are often heavily reliant on advice from someone in a brick and mortar store like Best Buy, who can easily make an off the cuff statement when asked by a consumer which device is recommended – only to have that person respond ‘Well, Fitbit just got bought by Google and we don’t know how that’ll end up’. The person turns and buys a competitor device instead.

Wrap-Up:

I’m never one to want to see less competitors in the space. But I’m not sure there was any other realistic option here. No, Fitbit wasn’t going to die this year or next year, or even in 2021. However, they were facing an issue of not being innovative anymore, which in turn causes loss of market share. Their Versa 2 launch this past summer was a prime example of that – where the global reaction was ‘shrug’. Combine that with the continued shift from lower-end activity trackers to highly integrated smartwatches like an Apple Watch, was becoming the perfect storm for the company.

They couldn’t really seem to fully lock and complete the various projects they’d announced. Whether that was the sleep tracking that took over a year to get out the door, or even broader music streaming services adoption. It was like things were stalling, as if the ship was just getting too heavy.

I think this acquisition though gives Fitbit a second life – but also gives Google a second life in the wearables realm. Remember, aside from Fossil, almost nobody was rolling out new watches with Wear OS. It had kinda sputtered.

I’m hoping we look forward to Fall 2020 with a Google Watch announcement. Something that can compete with Apple Watch in the mass market arena, but perhaps also have the flexibility to compete with companies like Garmin and others in the athletic focused space.

With that – thanks for reading!

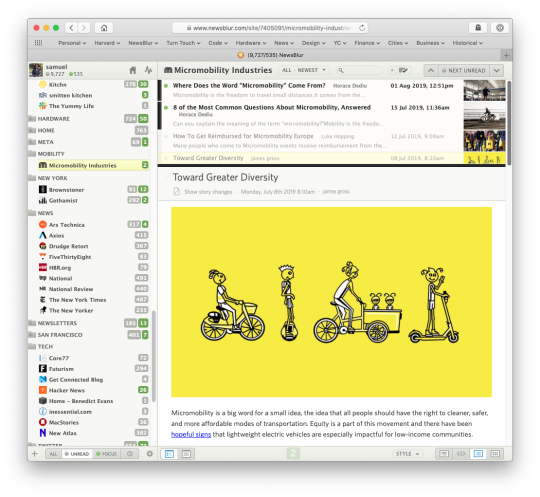

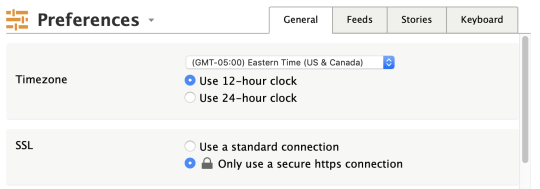

There are two ways to connect to the NewsBlur website. The first is http://www.newsblur.com. The second is https://www.newsblur.com. The first is plain text and the second is encrypted. You get to choose which one you want to use.

Part of the draw of using an encrypted https connection instead of a plain text http connection is that you can protect your privacy. As far as I can tell, there are two reasons for preferring https over http.

One is that using an encrypted https connection to NewsBlur protects what you read from hackers or a man-in-the-middle changing your data as it comes to you. This could be your internet service provider (ISP) inserting ads or it could be snooping wifi router that you are connected to that injects malware into your content. Some companies have been known to do this and https protects you.

But the second reason is that your privacy is also protected from more benign, aggregate collections by ISPs and middlemen that sees what you read and sells that data. NewsBlur doesn’t sell any of your data and beginning this week NewsBlur can ensure that nobody other than you and the site you read can either.

The feature that is launching this week (it actually launched Monday in order for me to ensure that it works well) is a secure image proxy for all images served on NewsBlur. That means that NewsBlur will take any images that isn’t behind an encrypted https connection and proxies it behind NewsBlur’s own secure, encrypted connection.

You should notice next to no difference. The only difference you may notice is that some images may load faster, since NewsBlur has a thicker pipe to the Internet and can download data faster than your client browser can, which means that your persistent connection to NewsBlur’s servers takes over instead of having to make new connections with the associated overhead to various servers around the net.

Now you can turn on the SSL setting on the NewsBlur Web and ensure your data stays private.

And to answer the question of why you wouldn’t wan t to use https — it used to mean serving and loading pages over https gave a slight performance hit, but that’s no longer true. But some people use http because it will load images from both http and https websites, whereas loading NewsBlur via https means that you can only load images via https, as loading an image via http will throw up a Mixed Content Warning. This update addresses that issue and it is my hope that http-only will be phased out.

I should switch to a self-hosted Jekyll like I recently switched for my personal blog, http://ofbrooklyn.com.

In high school, I was voted “most optimistic,” one of those senior superlatives that only functions on the periphery of what our peers really care about. We opened our yearbooks for “best eyes” or “best looking” or “class clown.” I had no idea why I got that vote.

Like any other teen, I dealt with my own layers of daily High School Shit, both real and make believe. I had good friends, but never felt popular enough. I was on athletic teams, but never the cool ones. I got good grades and dreamed about what college might hold for me.

I had bad acne. I often felt sad. Sometimes depressed. And, looking back from today, can’t recall how optimism came to be a part of that routine, let alone what everyone saw that I obviously missed.

I also now realize, years later, that I should have been more welcoming of such a compliment. Whether in an archival book dedicated to memories people may want to forget as easily as remember, or in real life, I was simply bad at accepting that kind of treatment. Mostly because I felt I didn’t deserve it.

Generally speaking, I’m bad at accepting words of praise, but definitive statements of personal qualities, especially democratically voted ones, felt more like a burden than benefit. At the time, there were definitely days where a forced smile was needed. Finding aspects of authentic optimism was probably more daunting than anything.

But it’s also a good thing that’s all in the past. Personal growth is slow and hard. Pretty much everyone is not wired for automatic self-awareness. It takes work. And now, on the new side of my latest birthday, it feels good to take stock and realize that maybe I did deserve that commendation so long ago.

Having a birthday so close to New Year’s creates an odd connection to annual conversations of rebirth and renewal. As soon as I celebrate one on Jan. 1, it’s almost time to do it all over again. Near-universally, both dates act as an arbitrary reset button when we can or we’re supposed to reflect on all that was, and yet to be. But hot damn if jamming all that in the course of one week feels like a bit much. Fun, for sure, but a bit much.

This year, maybe for the first time, it doesn’t feel so bad. The self-awareness I could have really used when I was 18 has taken hold. Life experiences good, bad, terrifying, and altering all took place across 2018. They’re not over just because a year has passed, or because I got to turn 34, but I hope and think and believe I’m ready. For whatever.

We’re all lucky for what we have, and in a way, lucky for what we lose, too. Finding happiness, let alone holding onto ways to remain happy, is humanistic work we all put in, with small increments, over the course of our lives. It’s about learning all the time. To be OK with looking on the bright side or finding the absurd in everything and laughing so god damned much you sometimes don’t know why you started in the first place. Belly laughs are fucking medicinal, I tell you.

Deep breaths help. And friends. And talking to people, whether personally close or professionally paid. It’s never easy, but, dear reader, it. is. worth it.

It wasn’t until a few years ago I stopped to think about that high school award of sorts bestowed on me by peers who knew me to various degrees. It never occurred to me at the time that the way they saw me, and what that meant to them, may have mattered. I tried hard in everything I did, even when it hurt. I just didn’t realize it. Ignorance to your own effort is a kind of blind optimism, I suppose. And maybe in the best way.

I had no idea why I got that vote back then. I’m really glad I got it today.